- FIAs

Fixed Index Annuities

Your Guide to Balanced Growth with Principal Protection

When your goal for retirement savings is an option that balances growth potential with protection from market volatility, a Fixed Index Annuity (FIA) might be the solution. FIAs offer a chance to earn interest that is linked to a traditional stock market index (like S&P 500), while keeping your principal protected from any downside.

What Makes FIAs Different?

Principal Protection

Your initial investment is completely safe from market fluctuations. You’ll never lose money due to economic volatility.

Market-Related Earnings

Any earnings are tied to the performance of a selected market index but have certain limits like caps, participation rates, and spreads. This provides the option for more potential growth than traditional fixed annuities but with much less risk than traditional market investing.

Tax-Deferred Growth

Your money grows without annual tax obligations until you decide to make withdrawals, allowing for more efficient compounding over time.

Flexibility

With FIAs, you can add optional riders or choose annuitization which provides a predictable retirement paycheck along with returns from your investments.

How FIAs Work

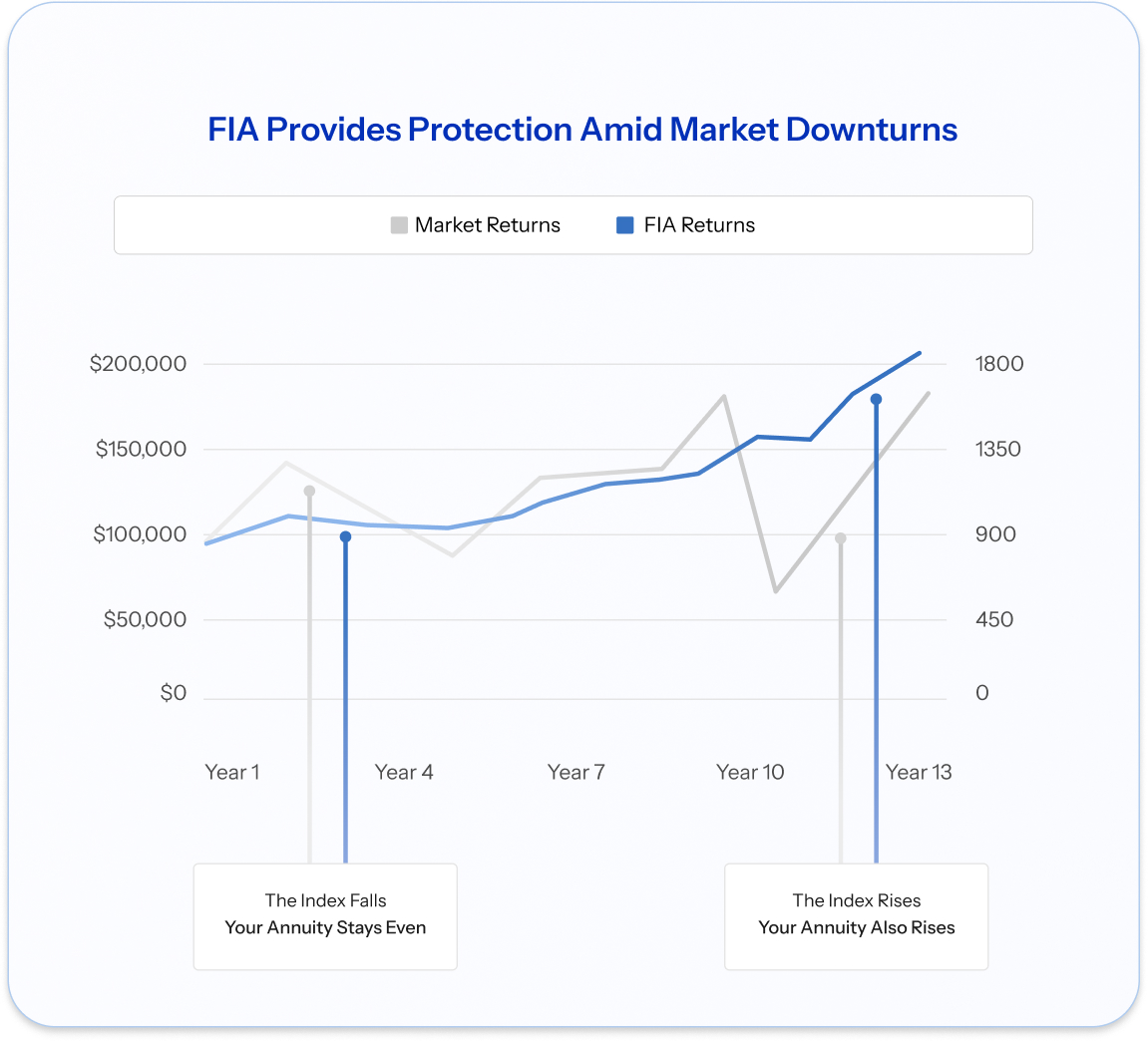

You can either provide a lump sum or commit to a series of payments to an insurance company, and your invested value grows depending on a formula that is related to the market index’s performance (with contract-specific limits). If the selected index decreases in value, you would avoid any losses but you wouldn’t receive interest during those periods. At the end of the contract, you can have options on how you want to receive the interest: as a lump sum, withdraw funds (depending on terms), or convert it to a stream of guaranteed income.

Contents:

Get personalized Fixed Index Annuity quotes.

Continued

Is a FIA Right for You?

FIAs tend to suit people who are:

Approaching Retirement

If you’re within 10-15 years of retirement, want to protect a portion of your investment from market volatility, and can weather short-term caps while benefiting from potential longer term market-linked gains.

Interested in Balancing Security with Growth

Those who want to not only earn interest linked to a trusted market index but also protection from losing principal.

Seeking Fixed Annuity Alternatives

People who prefer products with principal guarantees that exceed fixed annuity returns but with limited downside risk.

Important Considerations

Growth Limits

Returns are typically capped or can be reduced by participation rates and fees, so the gains may not be as great as if they were invested independently in the same index fund.

Limited Liquidity

Withdrawals may be limited and incur penalties if done early or beyond penalty-free amounts.

Insurance Company Risk

Guarantees depend on the issuing company’s financial position, unlike FDIC-insured products.

Current Market Environment

FIAs are an attractive option for inventors seeking controlled exposure to market gains with a protected principal, especially when the market is stable or rising. Rising and relatively high interest rates in the previous years have allowed insurers to offer better cap rates, higher guaranteed minimums, and more flexible crediting options.

Tax Considerations Made Simple

FIAs provide tax-deferred growth similar to other annuities, which means that taxes are only due upon withdrawal. Qualified purchases, (those made with retirement account funds) have regular income taxation on those withdrawals. Non-qualified purchases (made with after-tax money) are only taxed on the earnings.

How FIAs Compare to Alternatives

FIAs vs. Traditional Fixed Annuities

FIAs provide higher growth potential by linking it to an index’s performance, while fixed annuities give a set interest rate without any market exposure.

FIAs vs. CDs

FIAs offer tax deferral and a potential for higher returns overall. but there is less liquidity and FIAs are not FDIC insured.

Fixed Indexed Annuity

Fixed Annuity

Certificate of Deposit

Medium–high

Low–medium

Low

Yes, 100% guaranteed

Yes, 100% guaranteed

Yes, FDIC-insured

Limited, early withdrawal penalties

Limited, early withdrawal penalties

Limited until maturity

Low (principal is protected)

Very low

Very low

Tax-deferred growth

Tax-deferred growth

Tax-deferred growth

Yes, via optional Income Rider or annuitization

Optional, via annuitization

No

Making Your Decision

Before deciding on a Fixed Index Annuity, consider the timeline of your investment, your income needs, and your comfort with the complexity of the product and terms. If you are seeking growth beyond the traditional fixed rates with a built-in safety net for your investment, a FIA could be a great investment choice.

Key Questions to Ask Yourself

Do I understand the contract’s participation rates, caps, and fees?

Am I comfortable with capped growth versus full market exposure?

Can I commit the funds for the contract without needing the liquidity?

How does this fit with my other retirement savings strategies?

With FIAs, the most important piece is considering the guarantees and the limitations on growth and how this type of annuity meets your retirement income goals.

Contents:

Have more questions? Let’s chat.

A live advisor is standing by to answer your questions.

Jeremiah Konger

Annuity Advisor

Protect Your Nest Egg with a Fixed Indexed Annuity

Get a personalized quote in minutes – no obligation.

View Rates