- SPIAs

Single Premium Immediate Annuity

Your Solution for Guaranteed, Lifetime Income

A Single Premium Immediate Annuity (SPIA) is a contract that turns a lump-sum payment into a stream of guaranteed income, starting almost immediately, typically designed for retirees seeking stability and predictable cash flow. SPIAs prioritize simplicity and secure longevity by letting the buyer select payout options to fit personalized financial goals.

What Makes SPIAs Different

Guaranteed Income

SPIAs deliver fixed, regular payments that can’t be outlived, providing financial certainty for retirees and anyone needing dependable income.

Immediate Payouts

Once funded with a lump sum, payments start within a month to a year, making SPIAs attractive for those wanting income right away.

Customization

Available payout choices include lifetime income, period certain (fixed number of years), and joint & survivor options (covering spouse or beneficiary after death).

Longevity Protection

Payments continue for life or for a set time, as SPIAs are used to ensure retirees don’t outlive their income.

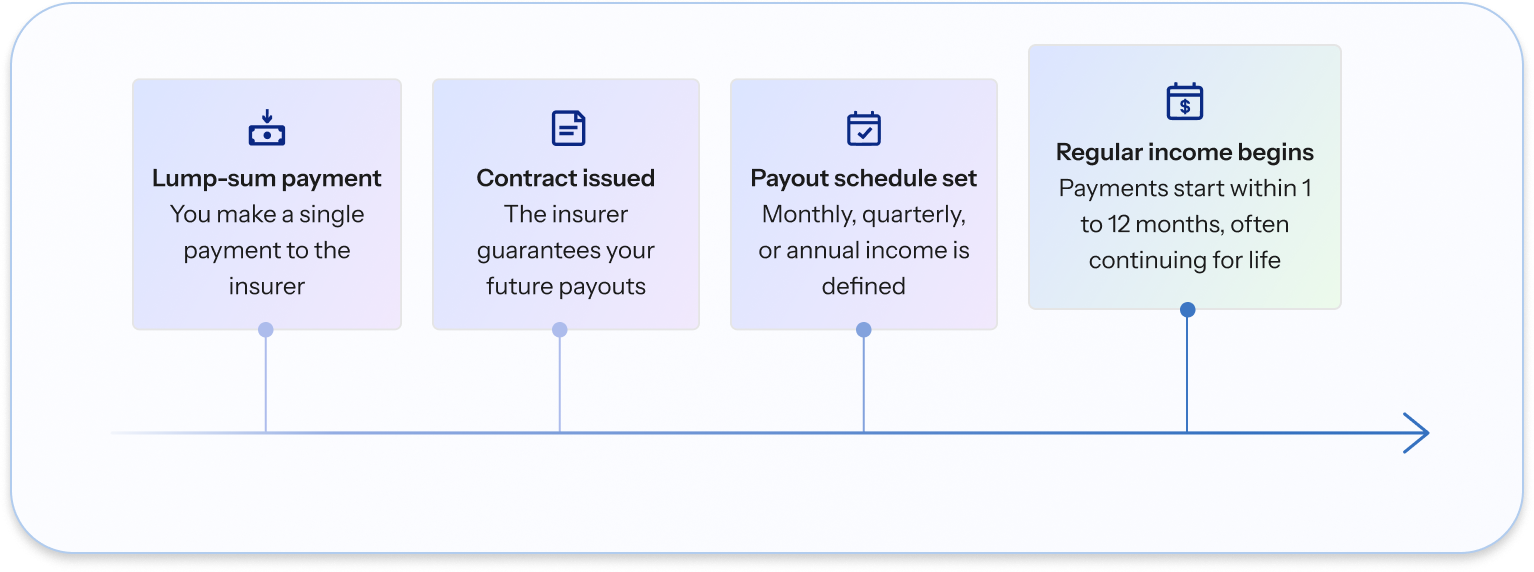

How SPIAs Work

The process is straightforward. You simply make a one-time lump sum payment to an insurance company. The lump sum is exchanged for a contract which spells out the exact details of the funding amount, the schedule of the payouts and the amount, any associated fees, and any beneficiary information.

Payouts can be monthly, quarterly, or annually, and chosen payout type will affect the payment size and duration. Most SPIAs offer lifetime payouts, guarding against outliving savings, as well as period-certain options guarantee income for a set period.

Contents:

Review today’s top Income Annuity rates.

Continued

Is a SPIA Right for Me?

SPIAs work particularly well for people who are:

In Retirement

Those who are in or closely approaching retirement and want a fixed, steady “retirement paycheck” that is not affected by market factors.

Comfortable Giving Up Liquidity

People that are willing to exchange principal control for consistent payouts that make for easier budgeting.

Worried about Longevity

Anyone experiencing concern about not having enough savings during a longer retirement period could benefit from consistent lifetime payment options.

Looking for Simplicity

People who are less interested in managing multiple investments or complicated investment schedules would benefit from the simplified “retirement paycheck” structure of this type of annuity.

Important Considerations

Liquidity Limitations

SPIAs require a larger upfront lump sum surrender and withdrawals or changes are generally not allowed.

Inflation

SPIAs pay scheduled, fixed amounts which may decline in value if there is significant inflation.

Limited Flexibility

Payouts, terms, and schedules are set so there is very limited flexibility in the contract once put in place.

Customization

SPIAs can have options that include inflation protection, joint survivor coverage, and guaranteed payouts for beneficiaries. There is also the option to add riders that may address liquidity or payment acceleration, but those typically cost extra.

Current Market Environment

Today’s interest rate environment has made SPIAs more attractive in recent years. Higher interest rates mean higher payouts because a SPIA pays fixed income that is based on existing rates. When rates rise, guaranteed payments rise - giving retirees stronger income streams compared to years with lower rates. SPIAs also offer no-market-risk income when in a more uncertain market.

Tax Considerations

SPIAs have different tax considerations depending on how they are funded. If the annuity is purchased with after-tax dollars (non-qualified), the payouts include a portion that is tax-free (return of principle) and a portion that is taxable income (earnings). If the annuity extends beyond the life expectancy used in the initial calculations of the contract, later payments may be subject to full taxation. If SPIAs are funded with pre-tax dollars, all of the payouts are taxable as ordinary income.

How SPIAs Compare to Alternatives

SPIAs vs. CDs

SPIAs offer the option to turn a lump sum into immediate lifetime income backed by the insurer’s claim-paying ability, whereas CD’s offer safe savings (FDIC insurance) with fixed interest.

SPIAs vs. Traditional Fixed Annuities

SPIAs are designed for immediate income, while traditional fixed annuities focus on growth first and then a later income phase. SPIAs start paying out almost immediately, while traditional fixed annuities have a deferred start date.

Single Premium Immediate Annuity

Fixed Annuity

Certificate of Deposit

Immediate, starts within 1 year

At maturity

Deferred

Funds locked, limited access

Low, FDIC insured

Market risk depends on type

No market risk

Low risk, FDIC insured

Low risk, FDIC insured

Guaranteed retirement income

Safe savings

Growth first, then income

Making Your Decision

Before choosing a SPIA, consider where you’re at or in retirement, your liquidity needs, and how it fits into your overall financial plan. If you’re comfortable committing an upfront lump sum with guaranteed payments over a protected amount of time, a SPIA could be a great choice for you.

Key Questions to Ask Yourself:

Can I commit to relinquishing a lump sum of cash upfront?

Will I need liquidity?

Am I comfortable with set payments rather than another investment with potential higher returns?

How does this fit with my other retirement savings strategies?

SPIAs offer immediate, guaranteed income in exchange for a lump sum, appealing to those wanting retirement certainty, hands-off financial management, and protection against outliving nest egg savings.

Contents:

Have more questions? Let’s chat.

A live advisor is standing by to answer your questions.

Jeremiah Konger

Annuity Advisor

Lifetime Paychecks, Starting Immediately

See how much guaranteed monthly income your savings can provide.

View Rates