Guaranteed Income Annuities

Ensuring Reliable Retirement Paychecks

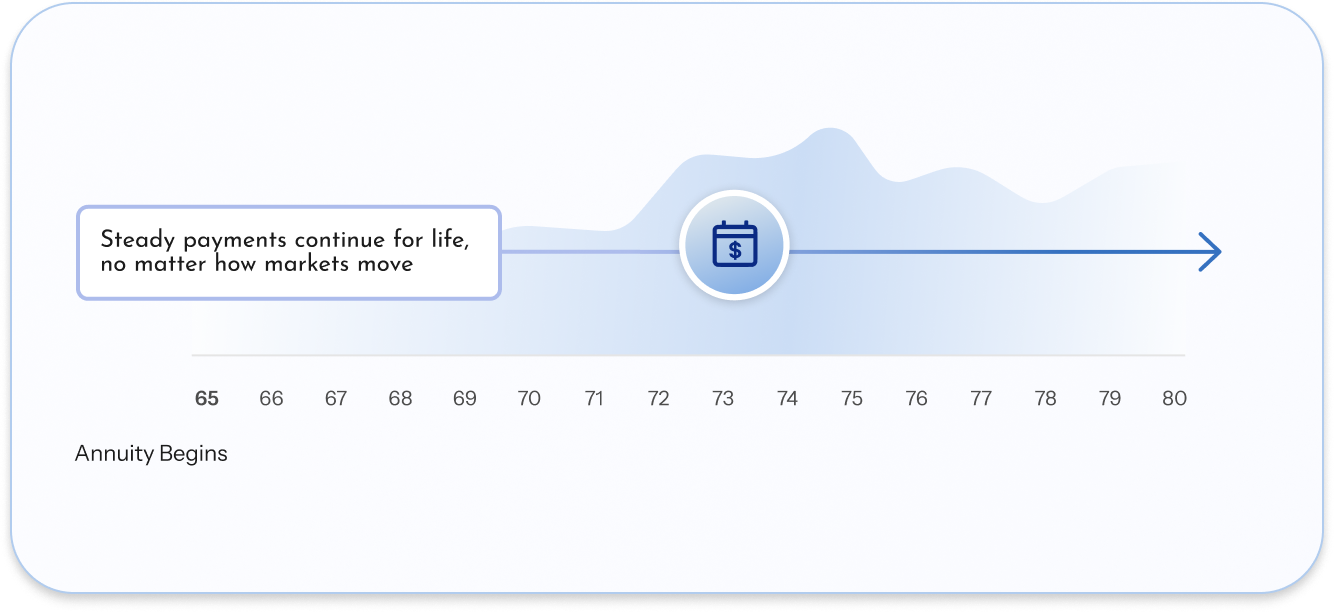

Annuities are financial products that help individuals save, generate income, and plan for retirement. When prioritizing predictable income, guaranteed income annuities—such as Single Premium Immediate Annuities (SPIAs) and Fixed Income Annuities + Rider (FIAs + Rider)—provide a steady income stream that can last for life, regardless of market performance.

What Guaranteed Income Annuities Can Offer

Annuities are financial products that can help individuals grow their savings, create future income, and plan for retirement. When focusing on protected growth, certain types of annuities, like fixed indexed annuities and variable annuities, allow your money to potentially earn more over time than traditional savings vehicles, while offering tax-deferred growth.

Lifetime Income Security

Which helps ensure that you never outlive your savings.

Protection From Market Downsides

Payments are set and ensured by your contract, no matter the state of the markets.

Peace of Mind During Retirement

You can rest easy knowing that part of your annuities will be covered by a guaranteed income source.

Who Might Want a Guaranteed Income Annuity?

This type of annuities can benefit individuals who value security and consistency over market-driven growth.

Nearing or In Retirement (Age 55+)

People who are shifting from accumulating wealth to seeking reliable, pension-like income.

Risk-Averse People

People who are worried about potentially outliving their retirement savings and are looking for income to last as long as they live.

Conservative Investors

People who are worried about market volatility and potential adverse effects on their investments.

Longevity Planners

People who are worried about potentially outliving their retirement savings and are looking for income to last as long as they live.

Contents:

Put your money to work for you.

Continued

When in Life Is an Annuity for Growth Most Useful?

Early Retirement Planning (Mid-50s to 60s)

Committing to a deferred income annuity will allow income to begin later in life, usually around age 70 or later. This creates a larger payout when you need it most.

During Retirement (60s to 70s)

You can use a portion of your savings to buy an annuity offering guaranteed income that starts immediately. This acts as a supplemental paycheck.

Planning for Longevity

Even in later retirement, you can lock in consistent income that can help with healthcare expenses and living costs without worrying about market volatility.

What Are Some Specific Benefits of Purchasing a Guaranteed Income Annuity?

Provides consistent monthly income to cover key expenses in retirement.

Offers protection against the possibility of outliving savings.

Appeals to more conservative investors who want less exposure to market risk.

Ensures a portion of retirement income arrives on schedule, regardless of market performance.

Guaranteed Income Annuity

Protected Growth Annuity

Lifetime Income

Growth Potential

Single Premium Immediate Annuities, Fixed Index Annuities with Income Rider

Multi-Year Guaranteed Annuities, Fixed Index Annuities

Guaranteed Fixed

Flexible, Not Guaranteed

Retirees, Couples

Pre-Retirees, High Earners

Security, Peace of Mind

Tax-deferred, Protection

Income Annuity Options

Guaranteed income annuities could be a great fit if you are close to or are currently in retirement and want the security of knowing that key expenses will be taken care of for the rest of your life. Learn more about such Single Premium Immediate Annuities (SPIAs) and Fixed Income Annuities + Rider (FIAs + Rider) to gather more information on different income annuity options. If you value security and stability, a guaranteed income annuity could be the right type of investment for you.

Contents:

Have more questions? Let’s chat.

A live advisor is standing by to answer your questions.

Jeremiah Konger

Annuity Advisor

Turn Your Savings Into Steady Income Today

Get a personalized quote in minutes, no obligation.

View Rates